Inheritance Tax is one of the most challenging areas of the SQE1 syllabus. It falls within ‘Wills and Intestacy’, which was the single most difficult area in terms of the marks from the last published SQE1 results.

To help you, we have produced:

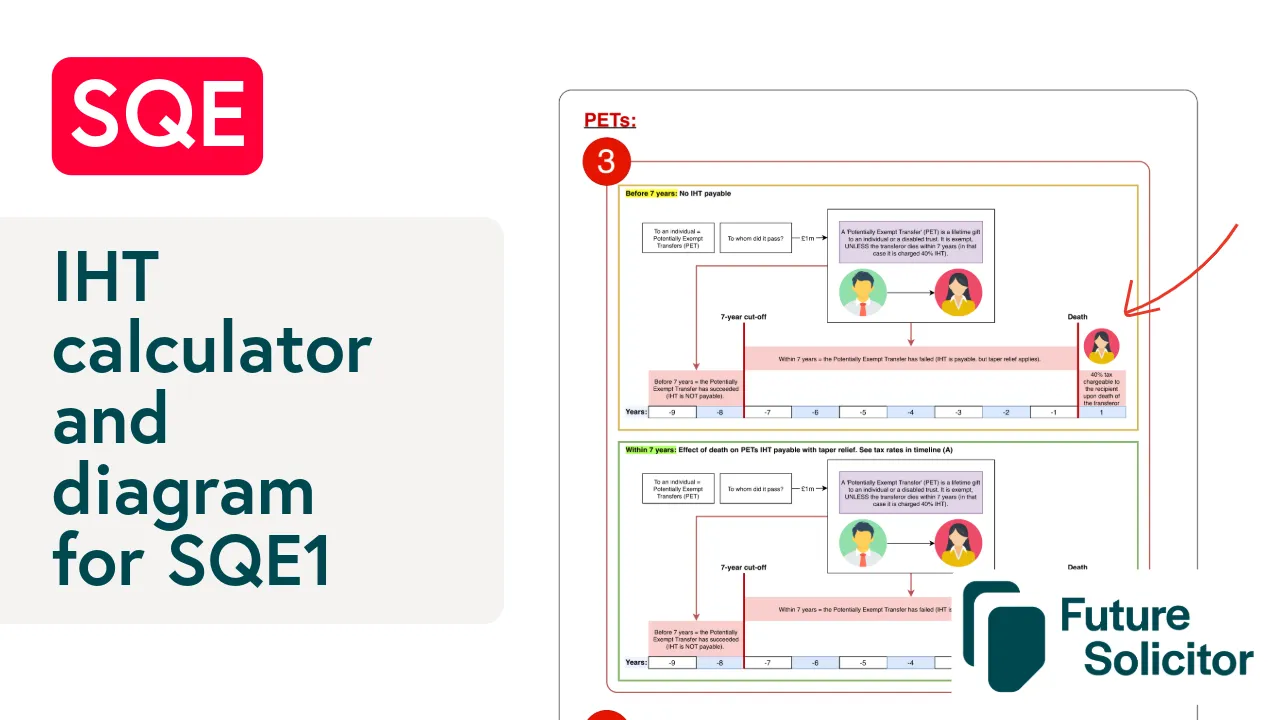

1. A comprehensive IHT concept diagram

This is a one-page visual that maps all IHT concepts that you need to understand, in one place. The diagram organises lifetime gifts (Lifetime Chargeable Transfers and Potentially Exempt Transfers), transfers on death, exemptions and reliefs, tapering, and the interaction of the nil rate bands, so you can see where each rule sits before diving into questions. Use it for quick refreshers before practice or as a revision tool.

2. Decision flowchart

This turns the rules into a clear logical structure you can use to tackle IHT questions. The flowchart walks through yes/no gates for immediately chargeable Lifetime Chargeable Transfers, the seven-year window logic for Lifetime Chargeable Transfers and Potentially Exempt Transfers (including taper relief), and the death estate path with and charity rate checks.

3. An IHT calculator

This means you can validate workings in minutes with minimal inputs and automatic checks. The calculator applies exemptions and reliefs, handles transferable Nil Rate Band where relevant, factors taper relief for lifetime transfers within seven years, and totals IHT due across categories. It’s built to reinforce learning without replacing notes, helping you to validate your learning.

We created this material to capture all points in one set of resources, and we were surprised to find that no other SQE provider has done the same. We hope you find them helpful and best of luck for the January 2025 exams!